Introduction

E-way bill is an electronic way bill for the movement of goods that is to be generated on the e-way bill portal. A GST registered person cannot transport goods without generated an e-way bill whose goods value is more than Rs. 1,00,000 or Rs. 50,000 in some other states (single invoice/bill/delivery challan) that is generated on e-way bill portal.

After the generation of an e-way bill, a unique e-way bill number (EBN) is allotted and this number is available to supplier, recipient and the transporter. It includes the entire details consigner name, consignee name, the point of origin of consignment, its purpose and direction.

Who should generate an E-way bill?

These persons can generate an E-way bill:

-

Registered Person

– E-way bill must be generated when movement of goods of more than Rs 1,00,000 or Rs 50,000 in some states in value to or from a registered person. A Registered person or the transporter can also generate and carry E-way bill even if the value of goods is less than Rs 1, 00,000 or Rs 50,000 in some states.

-

Unregistered Persons

– Unregistered persons may also require generating an E-way bill. However, where a supply is made by an unregistered person to a registered person, the receiver must follow all the compliances that are met as if they were the supplier.

-

Transporter

– Transporters who carry goods by rail, air, road, etc. also need to generate e-way bill in case of supplier has not generated an e-way bill.

Must Read :- Documents required for Private Limited Company registration

How to modify E way bill?

An E-way bill can be modified even after the generation on e-way bill portal in following circumstances:

- If vehicle breaks down

- If vehicle number not entered at the time of generating an e-way bill

- In case of Transshipment

- Reassigning e-way bill to other transporter

How to update vehicle number on E way bill?

In the part-A of an E-way bill, vehicle number is an optional field. But an e-way bill is not valid for the movement of goods without vehicle number. So, there is an option of update vehicle number on e-way bill portal. This option can be used in the following circumstances:

- If the vehicle number is not generate at the time of generation of an e-way bill;

- If vehicle breaks down during transit and goods are shifted to other vehicle.

This option can be used many times but within its validity period. It should be note that no other mistakes or defaults cannot be modified after the generation of an e-way bill.

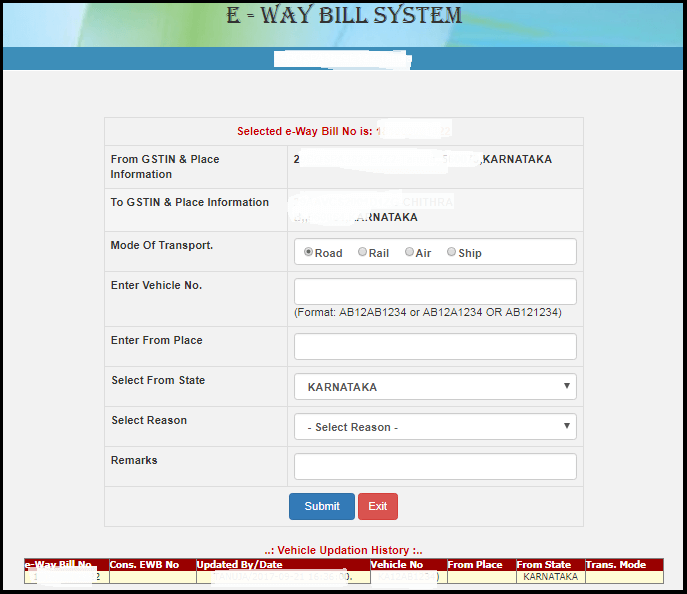

What is the process of updating vehicle number in e way bill?

There is a need of updating vehicle number if vehicle number is not generated at the time of generation of e-way bill or if vehicle breaks down during transit. Follow the below mentioned process of updating or modified the vehicle number of an e-way bill:

- Firstly, log in to the e-way bill portal i.e. gov.in.

- Select e-way bill option and choose update vehicle number.

- After choosing it, a new page will be opened. In it registered person, unregistered person or transporter, anyone can update the following:

- Vehicle number

- Place

- Select the reason for the modification- Not updating vehicle number, transshipment or vehicle breaks down.

- After entering all the details, click on submit button.

After submission, modified e-way will be generated and you can save or take print out of it.

How to reject E way bill?

There is also an option of rejection of an e-way bill on e-way bill portal. E-way bill can be rejected if the supplier has entered the incorrect details or such other party may not have delivered of goods. It means that if the goods did not reach the destination as it was cancelled on the way, the recipient can reject the e-way bill.

Conclusion

At last, we can say that an e-way bill can be modified in certain circumstances as above mentioned. This bill can also be cancelled within 24 hours of generation by the GST taxpayer or transporter. If you have any query, you can contact company suggestion. Or you can also contact us on our page companysuggestion.